It All Started with a Bowl of Cereal and Existential Dread

You ever sit down with a bowl of cereal at 2:47 PM, stare at the wall for 17 minutes, and question every life choice you’ve made since 2014? No? Just me?

Okay fine. But picture this: you’re supposed to be learning about crypto adoption, writing that blog, doing that side hustle… instead you’re Googling “do houseplants need emotional support?” while your cereal becomes a soggy crime scene.

Welcome to the Procrastination Olympics. I’m a gold medalist.

But just as I was about to deep-dive into whether succulents can sense sadness, something snapped. I opened my crypto tabs (yes, plural) and BAM—the GENIUS Act was plastered everywhere.

At first, I thought it was a Marvel villain. Turns out, it’s not evil. It’s kind of… brilliant?

Let’s talk about why this bill is the biggest deal in crypto adoption since someone said, “Wait… what if we don’t need banks?”

What Is the GENIUS Act, and Why Is It Making Crypto Nerds Cry Tears of Joy?

Short for Guiding and Establishing National Innovation for U.S. Stablecoins, the GENIUS Act is a 2025 Senate bill that gives the U.S. its first legit federal rules for payment stablecoins—you know, the digital dollars that aren’t memes or rug pulls.

Here’s the TL;DR:

- Only licensed banks or regulated firms can issue stablecoins.

- They must hold real, liquid assets—like U.S. Treasuries.

- Monthly public audits required. No funny business.

- Big players get federal oversight. Small ones stay state-regulated.

- Foreign issuers? You’re welcome… but play by the rules.

- Stablecoins are not securities.

This act doesn’t just make lawyers sleep better at night—it’s a massive win for crypto adoption.

Stablecoins Are Boring… and That’s a Good Thing

Let’s face it. Most people don’t get into crypto to HODL a dollar-pegged coin.

They want moonshots. They want Lambos. They want to send a JPEG to space.

But here’s the thing—mainstream adoption needs boring first.

Stablecoins are the quiet MVP of crypto. They:

- Let people transfer money instantly, 24/7.

- Work across borders with zero wire transfer fees.

- Power DeFi protocols without risking price crashes.

But until now, the U.S. had no serious federal guardrails. It was like letting toddlers run a lemonade stand next to a shark tank.

The GENIUS Act adds guardrails—without killing innovation.

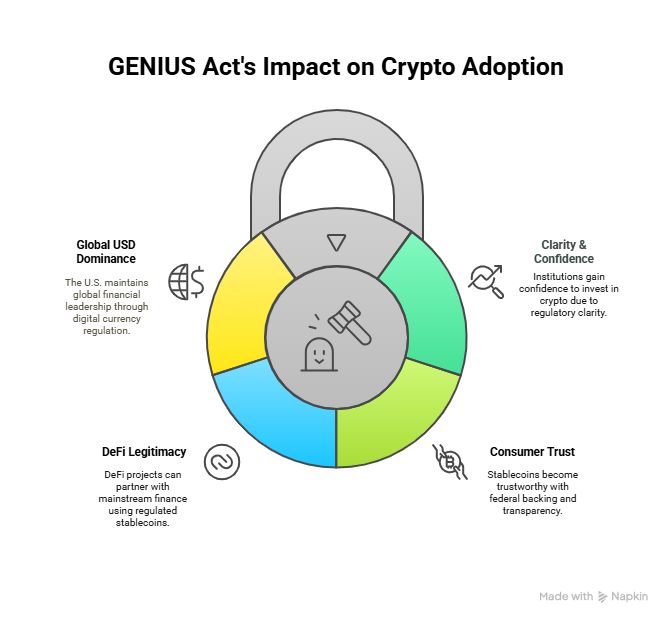

Why the GENIUS Act Is a Game-Changer for Crypto Adoption

Let’s break down how this law is quietly unleashing a new era of adoption:

🧷 1. Clarity = Confidence

Institutions like BlackRock and Fidelity have been dipping their toes in crypto. Now, they’ve got the clarity to cannonball in.

When Wall Street feels safe, mass adoption follows.

🛡️ 2. Consumer Trust Boosted

Ever been rugged by a stablecoin that “mysteriously” depegged? cough TerraUSD cough

GENIUS makes sure that can’t happen (legally) in the U.S.

People will start to trust stablecoins—because they’ll be federally backed, transparent, and redeemable.

💸 3. DeFi Goes Legit

This bill lets decentralized finance projects finally say: “We’re working with regulated stablecoins.”

That could open the door to mainstream fintech partnerships, payment apps, and even retail banks integrating crypto wallets.

🌍 4. Global USD Dominance—Digitally

Let’s be real: if the U.S. doesn’t lead with regulated stablecoins, China’s digital yuan will happily do it.

GENIUS isn’t just smart for crypto—it’s smart geopolitics.

Let’s Get Weird: What If This Act Fails?

Imagine this.

It’s 2026. The House rejects the GENIUS Act.

Stablecoins are still the Wild West.

Your grandma tries to pay for groceries using “BUTTCOIN69” and gets phished by a deepfake Elon Musk.

Meanwhile, Europe rolls out their digital euro. Nigeria launches airdrop-based tax refunds. China sets up vending machines that scan your iris.

And the U.S.? Still arguing over whether crypto is “money” or “magic beans.”

We can’t let that happen.

So… Is This the Crypto Turning Point?

Honestly? It might be.

The GENIUS Act is like giving crypto a seat at the grown-up table. With napkins. And sparkling water.

It sets the foundation for:

- Safer stablecoins

- Faster adoption

- Legal innovation

- Global relevance

It’s not the final boss fight—but it’s a solid checkpoint.

Quick Breakdown Table

| Feature | Before GENIUS Act | After GENIUS Act |

| Stablecoin Oversight | Patchy, unclear | Clear federal/state guidelines |

| Reserves | Sometimes shady | Must be fully backed & disclosed |

| Security Classification | Often debated | Stablecoins ≠ Securities |

| Global Standing | Falling behind | Reclaiming leadership |

| Retail Trust | Low to medium | Higher with transparency |

Final Thoughts (Aka My Cereal Revelation)

So, yeah. I started my day spiraling into cereal-based despair.

And now? I’m genuinely excited.

Because when a country finally figures out how to regulate crypto without choking it, that’s not just policy—it’s potential.

The GENIUS Act is a green light to builders, banks, and boomers alike.

Crypto adoption isn’t just a dream—it’s policy now.

👇 What’s Next?

- Are you bullish on regulated stablecoins?

- Think the House will pass it?

- Do you still emotionally support your houseplants?

Let’s talk. Drop your thoughts in the comments or share this post with your favorite crypto-curious friend.

v2rfdw

Pingback: How to Invest in Crypto Funds after a 10-Week Streak of Inflows - Blockchain Monie