The $2.44 Billion Shockwave: A New Era for Bitcoin Treasuries

Imagine this: a media company tied to a U.S. President raises $2.44 billion. It immediately allocates over $2.3 billion to Bitcoin Treasury. This is not a tech firm. Not a fintech startup. But Trump Media & Technology Group (TMTG), the parent company of Truth Social. That’s not just another corporate treasury move—it’s a political and financial earthquake.

The idea of a Bitcoin treasury is no longer novel. Companies like MicroStrategy and Tesla made headlines with their bold crypto reserves. But Trump Media’s entry into the game adds layers of geopolitical and cultural significance. We’re now looking at a future where Bitcoin isn’t just a financial hedge—it’s a political statement. Let’s dig deeper.

Bitcoin Treasury: From Financial Hedge to Political Weapon

A Bitcoin treasury strategy is simple in theory. Companies hold Bitcoin as a reserve asset to hedge against inflation and currency debasement. MicroStrategy famously pioneered this move, and its stock price saw substantial volatility as a result. But Trump Media is playing a different game. How, you may ask? Keep reading.

This isn’t just about portfolio diversification or macro hedging. By aligning financial strategy closely with Bitcoin treasury, Trump Media is effectively aligning with a broader anti-establishment, pro-sovereignty narrative. In today’s polarized climate, that carries major implications:

- Financial independence: Bitcoin offers an escape from fiat currency systems and central bank control.

- Political signaling: Associating with Bitcoin resonates with libertarian and conservative communities who value self-custody, decentralization, and limited government.

How Trump Media’s Bitcoin Treasury Stands Apart

While many companies are cautiously dipping into crypto, Trump Media is cannonballing into the deep end. Here’s how this strategy differs from other corporate Bitcoin plays:

| Feature | Trump Media | MicroStrategy | Tesla |

| % of Treasury in Bitcoin | Over 95% | ~85% | Minor portion |

| Strategic Motivation | Political & Financial | Financial Hedge | Speculative & Strategic |

| Timing | 2025 Election Cycle | 2020-2021 Bull Market | Early 2021 |

| Custodians Used | Anchorage Digital, Crypto.com | Coinbase Custody | Unknown |

| Public Messaging | Politically Charged | Financially Analytical | Low-key |

The Implications: Why This Strategy Could Reshape Power

1. Mainstreaming Bitcoin in Politics

Trump’s platform now openly supports cryptocurrency adoption. With Trump Media leading the charge, Bitcoin is no longer fringe. It’s becoming a mainstream political asset.

This political move forces other politicians to take a stance—pro or anti-Bitcoin. The political middle ground is eroding.

2. Challenging Traditional Finance

A Bitcoin treasury on this scale challenges the dominance of legacy financial systems:

- De-dollarization: A U.S.-based company rejecting USD for BTC is a radical shift.

- Bank disintermediation: Holding Bitcoin with regulated custodians like Anchorage Digital bypasses traditional banking rails.

- Financial autonomy: As crypto adoption increases, the power of centralized financial institutions weakens.

3. Creating a Sovereign Media Ecosystem

By funding itself with Bitcoin and engaging crypto-native communities, Trump Media is building an alternative economic system. It’s no longer reliant on Wall Street investors, traditional ad revenue, or Silicon Valley platforms.

The integration of memecoins (e.g., $DJT), crypto wallets, and decentralized finance (DeFi) tools into the Truth Social ecosystem signals a broader ambition: to create a parallel internet economy immune to censorship or financial throttling.

4. Inspiring Other Movements

This strategy could act as a template for:

- Populist movements globally seeking financial sovereignty.

- Corporate entities looking to detach from central bank dependency.

- Digital creators and DAOs building content platforms with integrated crypto rails.

Critics, Risks, and the Road Ahead

While bold, the strategy isn’t without critics or risks:

- Volatility: Bitcoin’s price swings could wreak havoc on financial statements.

- Regulatory uncertainty: The SEC and other agencies are watching closely.

- Political backlash: Opponents argue that politicizing Bitcoin undermines its neutrality.

Yet, for Trump Media, the upside appears to outweigh the risks. In a world of inflation, censorship, and geopolitical realignment, betting on Bitcoin becomes more than a hedge—it’s a declaration.

Final Thoughts: Is This the Dawn of a Bitcoin Nation?

Trump Media’s Bitcoin treasury strategy may be the most consequential crypto move since El Salvador made BTC legal tender. But this time, it’s not a nation-state leading the charge—it’s a private entity with deep political ties and a massive media megaphone.

If successful, it could:

- Inspire political movements around the world to adopt Bitcoin as a reserve asset.

- Accelerate mainstream crypto adoption in the U.S.

- Reshape the future of both finance and governance.

We’re witnessing a new paradigm emerge—where Bitcoin isn’t just money. It’s messaging. It’s momentum. And it might just be the fuel for the next chapter of political and financial transformation.

RECAP:

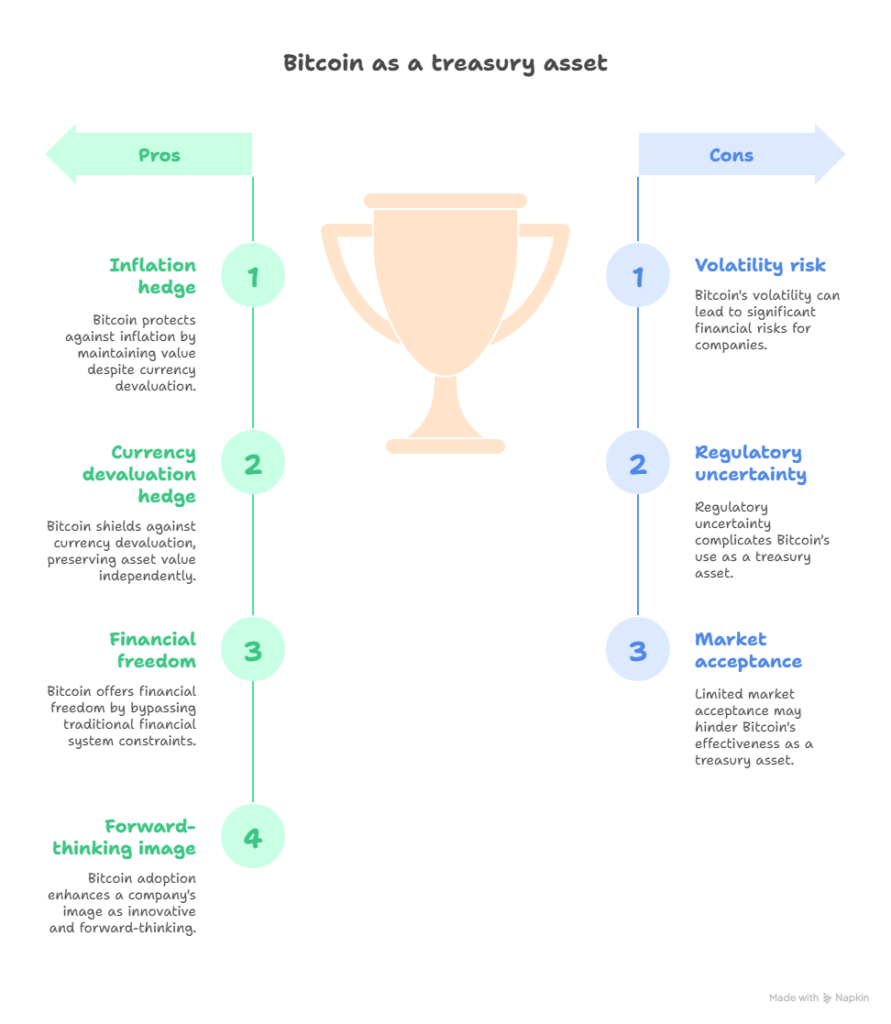

A bitcoin treasury refers to a company holding Bitcoin as part of its reserve assets to protect against inflation, currency devaluation, and financial instability. Trump Media is embracing a bitcoin treasury strategy by investing over $2.3 billion in Bitcoin. This move is both financial and political—aligning the company with a growing movement that values decentralization, financial freedom, and resistance to traditional fiat systems.

Trump Media’s bitcoin treasury strategy is unique in its scale and political intent. Over 95% of its corporate treasury is allocated to Bitcoin—significantly higher than MicroStrategy or Tesla. While MicroStrategy pursued Bitcoin as a financial hedge and Tesla treated it as a speculative asset, Trump Media is using its bitcoin treasury as a political statement and economic foundation for building an independent, crypto-aligned media ecosystem.

By adopting a bitcoin treasury, Trump Media is pushing Bitcoin into the heart of U.S. political discourse. It forces politicians to take a clear stance—either in favor of or against crypto adoption. The move positions Bitcoin as a mainstream political issue, potentially influencing campaign platforms, voter mobilization, and future regulatory agendas tied to digital assets and financial autonomy.

Like any company with a bitcoin treasury, Trump Media faces key risks, including:

Bitcoin’s volatility, which can impact financial stability.

Regulatory scrutiny, especially given the company’s political associations.

Public and political criticism, as using Bitcoin for ideological purposes may challenge its perceived neutrality.

Still, the company appears to view its bitcoin treasury as a strategic long-term asset that aligns with its goals of sovereignty and disruption.

Join the conversation below, subscribe for more updates on crypto, tech and finance shaping the future of money.

Pingback: From Trash to Treasure: Inside the Epic Quest to Recover a $742 Million Bitcoin Fortune - Blockchain Monie

Pingback: What You Need to Know About Michael Saylor’s Bitcoin Buy Signals - Blockchain Monie

Pingback: How to Invest in Warner Bros Discovery Split: Your Guide to Winning Big in 2025 - Blockchain Monie

Pingback: The GENIUS Act Explained: A Game-Changer for Crypto Adoption - Blockchain Monie

1smmxs