Somewhere between the memes and mayhem, I stumbled across a phrase that made me do a double take: “Crypto Funds See 10 Straight Weeks of Inflows.” Wait… people are still investing in this market? Like… seriously?

Turns out, they are. And not just random Degen warriors—big money, institutional money. Over $15 billion has poured into crypto funds recently, and that’s no fluke. If you’ve been on the fence, endlessly refreshing charts or waiting for “the perfect moment,” this might be it.

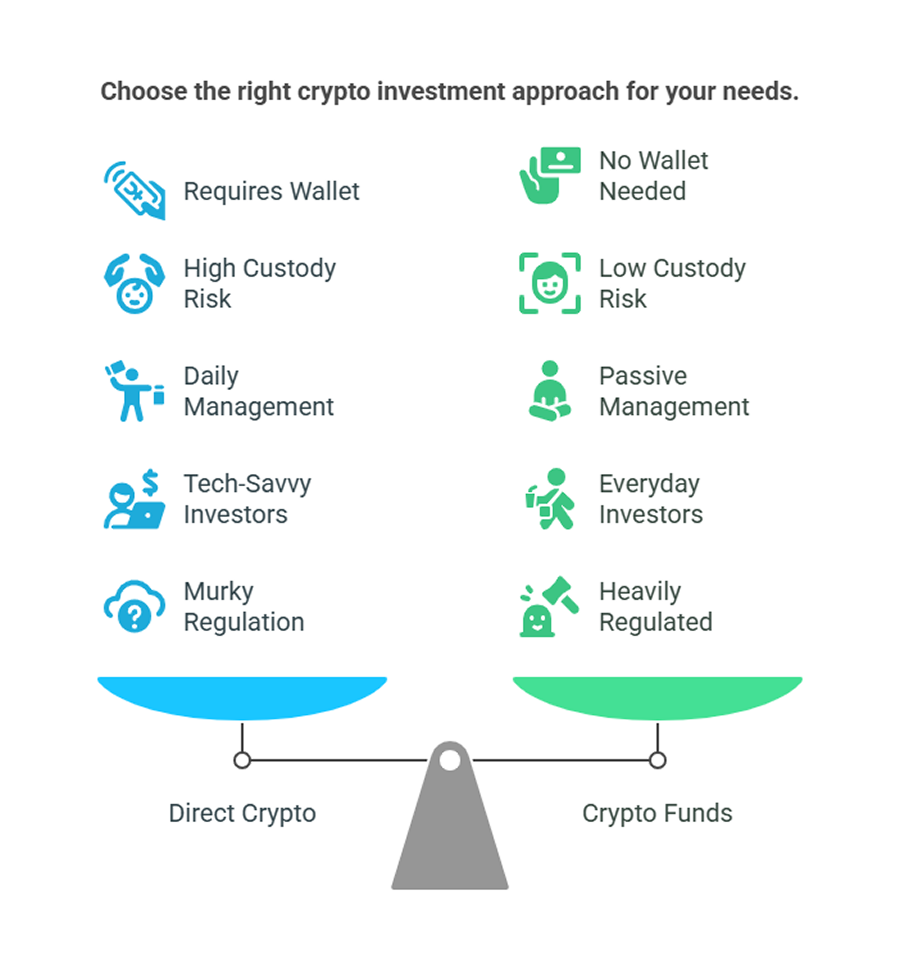

In this post, we’ll break down what crypto funds actually are, why they’re gaining steam in 2025, and—most importantly—how you can jump in without needing to decode blockchain gibberish or memorize 12-word seed phrases.

Why Everyone’s Talking About Crypto Funds (Again)

Crypto funds are riding high after a 10-week streak of inflows. We’re talking over $15 billion pouring into Bitcoin, Ethereum, and other digital assets since April 2025. Institutions aren’t just dipping their toes anymore—they’re cannonballing in.

So what exactly are crypto funds?

- Think mutual funds or ETFs, but with crypto.

- Managed by professionals.

- Lower learning curve than trading coins directly.

- Includes BTC, ETH, and possibly altcoins like Solana or XRP.

And with BlackRock, Fidelity, and ARK Invest expanding their offerings, this isn’t fringe finance—it’s prime-time investing.

So… Why Are Crypto Funds Getting So Much Love?

Let’s break it down:

1. Big Money’s Moving In

When institutions move, you move. If you’re waiting for “the right time,” this could be it.

- $1.2 billion entered crypto funds in just the last week.

- 10 consecutive weeks of inflows is a record.

- BlackRock is expanding beyond Bitcoin and Ethereum ETFs.

2. Safer Access to Crypto

Crypto funds give you exposure without the “wait… where did I put my recovery phrase?” anxiety. They’re regulated, often insured, and come with investor protections.

3. More Choice, Less Chaos

Want to invest in Ethereum without reading 47 whitepapers? Done. Crypto funds bundle that complexity into one product.

Stop Guessing and Started Allocating

Here’s the thing: You can spend years overthinking every crypto buy. “Is now a good time? Should I wait? What’s the Fed doing?”

Instead, just committed to a monthly contribution into a diversified crypto fund—primarily BTC and ETH. And you know what? You will sleep better. No charts at 2 a.m. No panic trades. Just slow, steady exposure.

How to Start Investing in Crypto Funds

Alright, here’s the action plan. No jargon. Just steps:

1. Pick Your Platform

Look for reputable platforms offering crypto ETFs or trusts:

- Fidelity

- Charles Schwab

- BlackRock (via iShares)

- Grayscale (OTC-listed trusts)

2. Choose Your Fund

Focus on funds with:

- High volume

- Clear expense ratios

- Major assets like BTC/ETH

Popular choices:

- GBTC (Grayscale Bitcoin Trust)

- ETHE (Grayscale Ethereum Trust)

- IBIT (iShares Bitcoin ETF)

- FBTC (Fidelity Bitcoin Fund)

3. Allocate Like a Boss

- Start small (1–5% of your portfolio).

- Dollar-cost average monthly.

- Reassess quarterly—not hourly.

What to Watch in the Coming Weeks

Keep your eyes peeled for:

- Legislation: The GENIUS Act is stabilizing the crypto landscape.

- ETF Expansions: Expect more altcoin ETFs soon.

- Geopolitical triggers: These can swing prices short-term but don’t panic.

Final Thoughts: You’re Not Late—You’re Early (Still)

If you’re worried you’ve missed the boat, relax. Institutions are just getting started. You’re on the ground floor of something big.

And if you’ve made it this far without clicking away — congrats. You’re already more disciplined than 90% of crypto Twitter.

So maybe you don’t need to become a crypto expert. Maybe you just need to invest in crypto funds, sit back, and let the big dogs do the heavy lifting. Still confused? Drop your questions in the comments, or share this with that friend who thinks Bitcoin is just “digital Monopoly money.”

Pingback: Google’s $90B revenue jump - top stocks and shares opportunities - Blockchain Monie