You ever wake up, spill coffee on your shirt, stub your toe on the chair, and just think, “Yep, today’s gonna be trash”? Then—bam! You check your portfolio (or Twitter, let’s be honest), and see Google just reported a $90 billion revenue jump. Suddenly that coffee stain feels like battle armor. Because if you’re paying attention, this isn’t just a tech flex—it’s a goldmine for stocks and shares opportunities.

And yes, $90 billion sounds like a made-up number. Like the amount you’d claim you need to “rescue a cat from the moon.” But this isn’t sci-fi—it’s Wall Street reality. And for savvy (or at least curious) investors, it opens the floodgates to stocks and shares plays that could ride the Google wave and make your next coffee spill totally worth it.

Why Google’s Revenue Jump is a Big, Loud Signal

Alphabet Inc. (Google’s parent) just pulled a financial triple-double that has every investor’s eyebrows doing the worm.

- $90.3 billion in Q1 2025 revenue

- A 15% year-over-year growth

- Google Cloud and YouTube ad revenues up significantly

Alphabet’s latest earnings report reads like a flex thread on X.

Here’s the kicker: this isn’t just about Google. It’s a rising tide moment. This kind of windfall can lift not just Alphabet stock but an entire ecosystem of stocks and shares tied to AI, cloud computing, digital ads, and semiconductor tech.

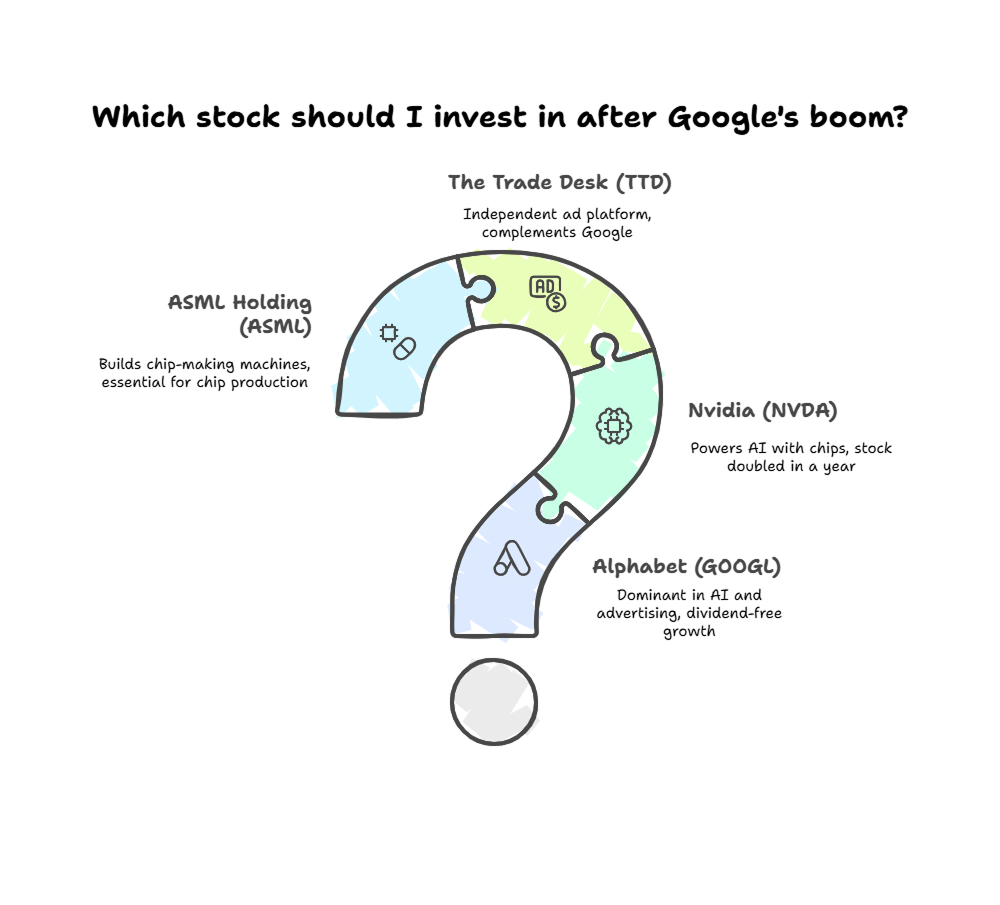

Top Stocks and Shares to Watch After Google’s Boom

1. Alphabet (GOOGL)

Let’s not be cute—if you believe in Google’s dominance, holding GOOGL is a no-brainer.

- Dividend-free, growth-packed

- Huge AI bets via DeepMind, Gemini, and cloud

- Strong advertising and YouTube monetization boosts

2. Nvidia (NVDA)

What powers Google’s AI obsession? Chips. And nobody does chips like Nvidia.

- AI demand = GPU gold rush

- Google uses Nvidia tech in AI and data centers

- NVDA stock has doubled in the past year

3. The Trade Desk (TTD)

Google’s ad success means digital adtech is booming. Enter The Trade Desk:

- Independent ad platform rising with privacy-first trends

- Huge potential in connected TV and global markets

- A play that complements—not competes with—Google

4. ASML Holding (ASML)

Google’s growth in AI and data centers means demand for chips. ASML builds the machines that make those chips.

- Dutch-based monopoly on EUV lithography

- Quietly essential to every chip you’ve ever loved

- Global exposure with tech insulation from U.S. politics

Join our Stocks And Shares Investment Masterclass to start trading in profitable stocks right away.

Best ETFs for the Lazy (or Busy) Investor

If buying individual stocks feels like assembling IKEA furniture blindfolded, ETFs have your back. Here are some tied to Google’s boom that you can just set and vibe with.

| ETF | Focus | Why It Works Post-Google Boom |

| QQQ | Nasdaq 100 | Heavy Google weight, plus tech titans |

| VGT | Vanguard Info Tech | Broad tech exposure with solid growth history |

| ARKK | Ark Innovation | High risk, high reward AI and future-tech |

These ETFs give you exposure to stocks and shares riding the AI, cloud, and advertising megatrends.

Real Talk – How I Missed the 2020 Google Train

Confession time.

Back in 2020, I thought investing in Google was “too obvious.” I went all-in on a crypto-mining startup that folded faster than my camping chair. Meanwhile, GOOGL doubled. I watched it all from a lawn chair… with poor WiFi. Lesson learned: sometimes the best stocks and shares opportunities are right in front of you, sipping coffee and running the internet.

Key Takeaways: What the $90B Tells Us About the Future

- AI is no longer “emerging” – it’s revenue-generating.

- Big Tech isn’t slowing – it’s consolidating power and profitability.

- You don’t have to be an expert – just follow the trend with informed ETFs.

- The stocks and shares space isn’t about hype—it’s about who benefits from innovation.

So next time life spills coffee on your morning, remember—there’s money moving somewhere. Right now, it’s moving toward Google and its orbit. You don’t have to be a tech wizard or chart analyst to benefit. Just follow the signal, ride the wave, and maybe—just maybe—turn your toe-stubbing morning into a portfolio win.