GameStop Corp. announced on May 28, 2025, its first significant foray into cryptocurrency by purchasing 4,710 bitcoins for approximately $513 million. This decision marks a pivotal shift in the company’s financial and strategic management. It seeks to diversify its asset portfolio and rejuvenate investor interest amidst declining sales in its core business of physical video game retail.

But is this bold step a calculated financial and strategic maneuver, or does it represent a high-risk gamble? To assess this, we must delve into the financial and strategic implications of GameStop’s Bitcoin investment.

Financial Management: A Calculated Move?

1. Leveraging Cash Reserves

As of February 1, 2025, GameStop reported holding approximately $4.8 billion in cash and marketable securities. This substantial liquidity provides the company with the flexibility to explore alternative investment avenues without jeopardizing its operational needs. By allocating a portion of these reserves to Bitcoin, GameStop aims to hedge against inflation and potential currency depreciation. This aligns with financial and strategic management employed by other corporations like MicroStrategy, which have integrated Bitcoin into their treasury reserves.

2. Convertible Debt Financing

To fund this acquisition, GameStop issued $1.3 billion in convertible bonds, a financial strategy reminiscent of MicroStrategy’s approach. These bonds offer investors the option to convert into GameStop shares by 2030, providing the company with immediate capital without incurring interest payments until the conversion date. While this approach mitigates short-term financial strain, it introduces potential long-term dilution risks for existing shareholders.

3. Potential Impact on Stock Performance

Despite the strategic nature of this investment, GameStop’s stock experienced a 10.9% decline on the day following the announcement. This reaction underscores the market’s cautious stance towards unconventional financial strategies, especially when they deviate from traditional business operations.

Strategic Management: A Shift in Corporate Direction?

1. Diversification of Business Model

GameStop’s pivot towards cryptocurrency signifies a departure from its traditional reliance on physical video game sales. This sector has been experiencing a decline due to the increasing popularity of digital gaming platforms. By integrating Bitcoin into its business model, GameStop seeks to position itself as a forward-thinking company, appealing to a broader investor base interested in digital assets.

2. Influence of Industry Leaders

The decision to invest in Bitcoin was influenced by discussions with industry figures like Michael Saylor of MicroStrategy. He has been an advocate for Bitcoin as a treasury reserve asset. This association lends credibility to GameStop’s financial and management strategy, aligning it with a growing trend among corporations embracing digital currencies.

3. Market Perception and Brand Image

While the move positions GameStop as an innovator in the gaming industry, it also risks alienating traditional investors who may view the cryptocurrency market’s volatility as a threat to financial stability. Balancing innovation with investor confidence will be crucial for GameStop’s long-term financial and management success.

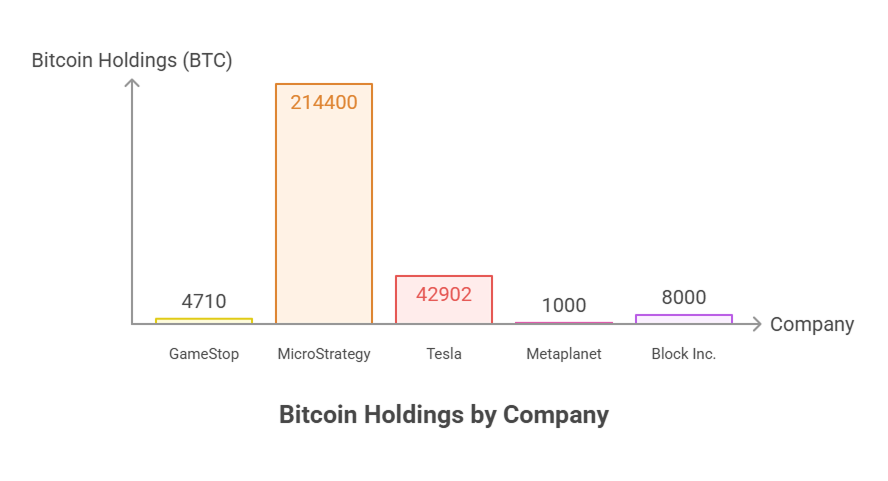

Comparative Analysis: GameStop vs. Industry Peers

| Company | Bitcoin Holdings | Strategy Overview | Market Reaction |

| GameStop | 4,710 BTC (~$513M) | Diversifying asset portfolio; hedging against inflation | Stock declined 10.9% post-announcement |

| MicroStrategy | ~124,946 BTC | Long-term Bitcoin accumulation as primary treasury reserve | Stock price surged with Bitcoin’s rise |

| Tesla | ~42,902 BTC | Initial Bitcoin purchase followed by partial liquidation; focus on innovation | Stock impacted by Bitcoin’s price volatility |

| Metaplanet | N/A | Transitioned from hotel management to Bitcoin holdings; stock soared 275% in 2025 | Positive market reception due to clear strategic pivot |

Risks and Considerations

1. Volatility of Bitcoin

Bitcoin’s price is notoriously volatile, with significant fluctuations occurring over short periods. For instance, within 12 months, Bitcoin’s value can experience an 80% decline. Such volatility poses a risk to the stability of GameStop’s financial and management strategy, especially if the cryptocurrency market experiences a downturn.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain, with potential for increased scrutiny and regulation. GameStop’s exposure to Bitcoin could subject it to unforeseen legal challenges, impacting its operations and financial performance.

3. Dilution of Shareholder Value

The issuance of convertible bonds introduces the possibility of share dilution. This could affect existing shareholders’ equity and influence investor sentiment.

Conclusion:

GameStop’s $513 million Bitcoin investment represents a bold and unconventional approach to financial and strategic management. While it offers potential benefits such as diversification and alignment with industry trends, it also introduces significant risks related to market volatility, regulatory uncertainty, and shareholder dilution.

The success of this strategy will depend on GameStop’s ability to navigate these challenges. It must do this, while effectively integrating Bitcoin into its broader business model. If managed prudently, this move could redefine GameStop’s position in the market, transforming it from a traditional retailer to a forward-thinking, tech-savvy company. However, failure to mitigate the associated risks could exacerbate existing financial challenges and erode investor confidence.

RECAP

GameStop invested in Bitcoin to diversify its asset portfolio and hedge against inflation and currency depreciation. This strategic move aims to rejuvenate investor interest amid declining sales in its core physical video game retail business.

GameStop funded the Bitcoin acquisition by issuing $1.3 billion in convertible bonds. This financing approach provides immediate capital without incurring interest payments until conversion, though it poses potential long-term risks of shareholder dilution.

Following the announcement, GameStop’s stock price dropped by 10.9%, reflecting market caution toward unconventional financial strategies and the volatility associated with cryptocurrency investments.

GameStop’s approach is similar to MicroStrategy’s long-term Bitcoin accumulation strategy but differs from Tesla’s more volatile Bitcoin holdings. Unlike MicroStrategy, which saw stock gains tied to Bitcoin price increases, GameStop’s stock initially declined post-announcement.

Key risks include Bitcoin’s high price volatility, potential regulatory challenges in the cryptocurrency space, and dilution risk for shareholders due to the convertible bond financing method.

Pingback: Financial Freedom or Risky Gamble? Trump Media Invests $2.44B in Bitcoin - Blockchain Monie

Hey there!

I came across your new site in a Newly Registered Domain database—nice to see you’ve kicked things off with WordPress! I’m Michael from DataHarvestPro, and I couldn’t help but notice the clean, simple theme you’ve got going. It’s a great starting point, and it got me thinking about how you might take it to the next level.

Here’s a little secret we’ve learned: even a basic site can make a big impression with the right insights—like figuring out what your visitors are looking for or giving your site a little extra polish to stand out. At DataHarvestPro, we specialize in helping folks like you do just that, and we only get paid once you’re thrilled with the results.

If you’re curious, I’d love for you to check out https://dataharvestpro.com — just a quick visit—to see if we can help bring your ideas to life.

Congrats again on launching your site! What’s your next big move for it?

Michael McKinnon

Sales & Marketing Team

DataHarvestPro.Com

Email: michael@dataharvestpro.com

Thanks for your warm welcome and invitation to check out your platform. I’ve checked it out and will definitely reach out to you when your service is needed.

l9vdqk