The future of crypto is here — and I almost missed it because I got distracted trying to find the perfect background show while “researching.” Spoiler: I watched five episodes of a baking competition and learned nothing about ETFs, but everything about croissants.

We’ve all been there, right? Classic procrastination.

But listen — if you’ve ever wondered what happens when the biggest name in traditional finance starts building on blockchain, this one’s for you.

Because BlackRock isn’t just flirting with crypto anymore. They’ve moved in. And it’s changing the future of crypto forever.

💼 Meet BlackRock: The G.O.A.T. of Finance

BlackRock isn’t your average finance bro.

With over $10 trillion in assets under management, they’re the heavyweight champion of the investment world. Think of them as the Beyoncé of Wall Street. Quietly dominant. Always in control.

So when BlackRock starts dabbling in Bitcoin ETFs and launches tokenized funds on Ethereum, it’s not a casual experiment. It’s a full-blown pivot toward the future of crypto.

They’re not testing the waters. They’re diving headfirst into digital finance — and taking the suits with them.

📈 The Bitcoin ETF Boom

Let’s start with the now-famous iShares Bitcoin Trust (IBIT) — BlackRock’s shiny new Bitcoin ETF.

It launched with a bang and quickly became one of the fastest-growing ETFs ever, amassing over $15 billion in assets.

And what does this mean for the future of crypto?

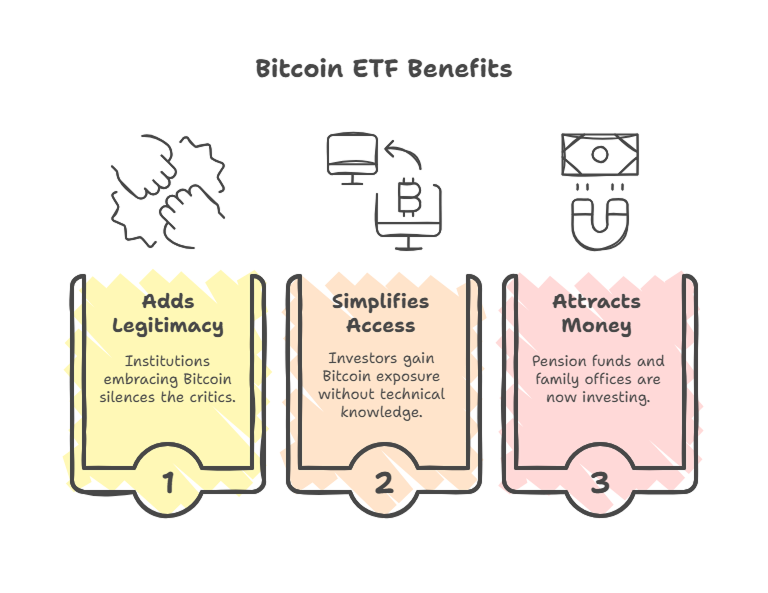

- It adds legitimacy. When institutions like BlackRock embrace Bitcoin, the “magic internet money” jokes suddenly get quieter.

- It simplifies access. Investors can gain Bitcoin exposure without fumbling private keys or learning what a cold wallet is.

- It attracts big money. Think pension funds, family offices, endowments — all playing it safe until now.

The ETF is like a velvet rope being lifted for institutional investors to walk into crypto with swagger. And yes, it’s a huge deal.

🔗 Tokenized Funds: Blockchain Goes Suit & Tie

If ETFs are the opening act, tokenized funds are the headliner.

BlackRock didn’t stop with Bitcoin. In March 2024, they launched BUIDL — a tokenized U.S. Treasury fund built on Ethereum.

Yes, Ethereum.

This isn’t just a crypto-friendly gesture. It’s a whole new business model. Tokenized funds let you:

- Trade traditional assets 24/7

- Settle instantly, not in two days

- Fractionalize ownership for broader access

This changes the future of crypto by blurring the line between traditional finance (TradFi) and decentralized finance (DeFi).

Want a slice of a real estate fund or U.S. Treasuries on-chain? That’s the world we’re entering.

And BUIDL is already being adopted by names like Coinbase, Fireblocks, and Anchorage.

This isn’t “coming soon.” It’s already happening.

🧠 Why Tokenization Matters for the Future of Crypto

Let’s connect the dots.

Tokenization = taking real-world assets and putting them on-chain. Why does that matter?

Because it’s about efficiency, access, and automation.

Here’s what it unlocks:

| Benefit | TradFi | Tokenized Assets |

| Market Hours | 9-5, weekdays | 24/7 |

| Settlement | T+2 days | Instant |

| Ownership | Often exclusive | Fractional & inclusive |

| Transparency | Opaque | Fully auditable on-chain |

This is the future of crypto people dreamed about — but now it’s being powered by actual trillion-dollar institutions.

⚠️ But… It’s Not All Unicorns and ETH Rainbows

Let’s pump the brakes for a second.

While it’s exciting, this institutional wave comes with caveats:

- Centralization risk: Tokenized assets controlled by megafirms could reduce decentralization.

- Surveillance: Real-world assets on-chain might come with baked-in tracking and control.

- Accessibility: Right now, most tokenized products are still for institutions, not your average crypto user.

So yes, it’s bullish for the future of crypto, but also a reminder: we need to build smart, not just fast.

🤯 A Personal Realization: Crypto Isn’t Just “Buy Low, Wait, Pray”

For the longest time, I thought crypto was:

- Buy a coin.

- HODL.

- Hope Elon tweets.

But seeing BlackRock get into tokenization made me realize — this tech is becoming infrastructure.

We’re not just trading assets anymore. We’re rebuilding finance, piece by digital piece.

The future of crypto isn’t just meme coins and yield farms. It’s treasury markets, real estate, bonds, and businesses — all on-chain.

You’re not just early. You’re in the right room.

🔮 So… What Now?

Here’s what to keep in mind:

- Watch the ETFs: More products = more inflows = more adoption.

- Track tokenization: It’s the real revolution. Stay updated on platforms like Etherscan and CoinDesk.

- Stay curious: The future of crypto is forming in real time — and you’re not just a spectator.

🎯 Final Thought: We’re All Still Figuring It Out

If you ever feel overwhelmed, remember this:

Even the finance pros are Googling “what is a tokenized fund?” between meetings.

The future of crypto doesn’t belong to perfect people. It belongs to the curious, the patient, and the ones who ask the questions no one wants to admit they don’t know.

So keep asking.

Keep learning.

Still trying to figure out what this all means for your wallet?

👇 Drop a comment. Share your thoughts. Or check out our breakdown of Bitcoin moves to see how price, volume, and news collide.

Crypto’s future isn’t written yet. Let’s help shape it — together.