🚨 It Started with Me “Researching” on YouTube…

Let’s be real.

You ever sit down to get something important done, like checking Bitcoin moves, and suddenly find yourself watching a 48-minute documentary on why pigeons are government drones? No? Just me?

One minute I’m pulling up TradingView to look at BTC’s volume trends. The next? I’m deep into conspiracy TikToks, and somehow also shopping for a neck pillow shaped like a banana. Productivity? Gone. Respect? Questionable. Snacks? Of course.

And look, I’ll admit it — for the longest time, I pretended I understood Bitcoin price charts. I’d squint at candlesticks like they were ancient runes, whisper “bullish divergence” under my breath, and hope nobody asked questions.

But then I discovered a real secret to timing Bitcoin moves: combining volume metrics with geopolitical clues. Not only did I stop fake-trading like a wizard at Hogwarts, but I also started making smarter decisions — and dodging more FOMO than a boomer on Discord.

So, let’s dive in. No fluff. No neck pillows. Just clear, actionable stuff to help you stop guessing and start understanding Bitcoin’s dance moves.

📈 What Volume Metrics Actually Tell You

Think of Volume Like Crowd Noise at a Concert

Volume tells you how many people are in the market and how loud they’re trading.

When volume is high during a price move — whether up or down — that move is more likely to be legit. Low volume? It’s like clapping after a bad magic trick. Doesn’t mean much.

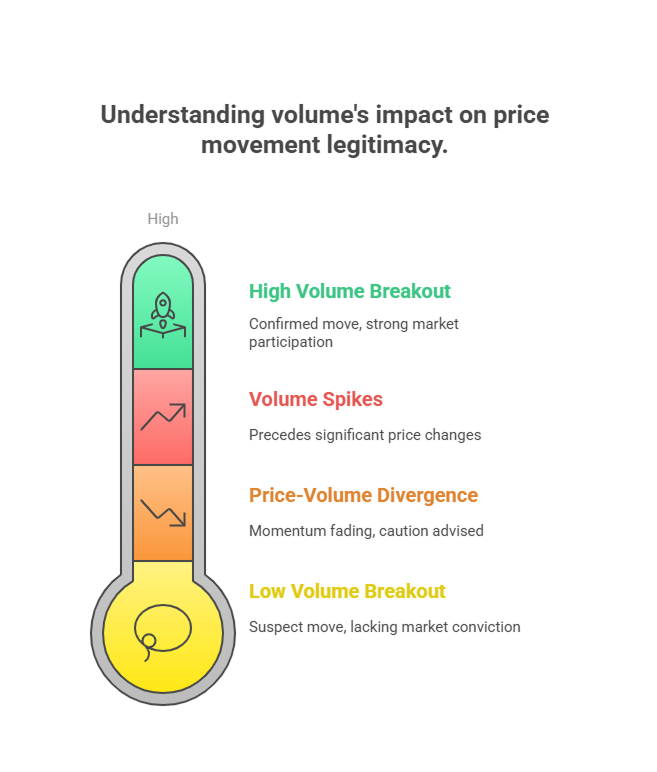

Here’s what to watch:

- Volume Spikes: These often precede big moves. Like someone pulling back a slingshot.

- Volume on Breakouts: A breakout on high volume = “real move.” A breakout on low volume? Sus.

- Divergence Between Price & Volume: Price going up but volume going down? Momentum’s dying. Time to be cautious.

🌍 Geopolitical Clues: The Secret Sauce Behind Bitcoin Moves

Bitcoin doesn’t live in a vacuum. It thrives (or crashes) on global chaos.

Here’s the playbook:

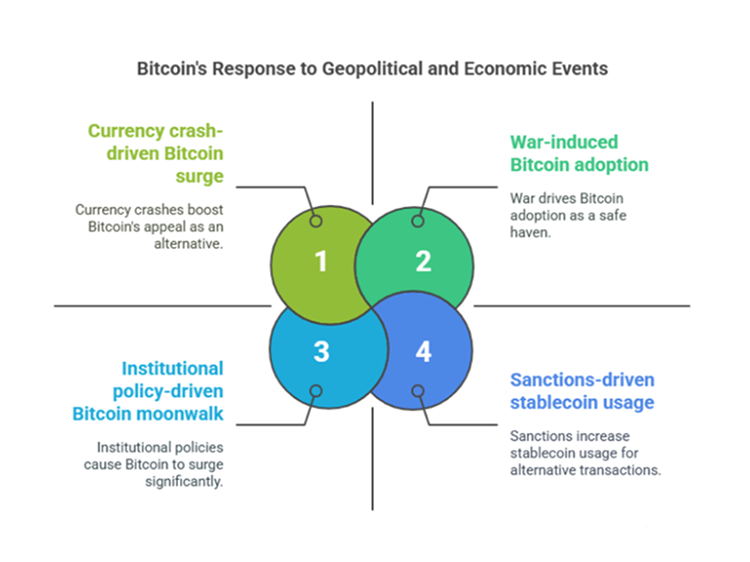

- War or Conflict? Investors panic — some flee to Bitcoin as a safe haven. Others liquidate crypto to cover traditional losses.

- Currency Crashes (Argentina, Lebanon, Nigeria)? Bitcoin adoption surges. People look for value escape hatches.

- Sanctions or Capital Controls? Crypto usage spikes — especially stablecoins and BTC — as citizens seek alternatives.

- Institutional Policy Moves? When the U.S. approves ETFs or China flips bullish, Bitcoin doesn’t just twitch — it moonwalks.

🧠 Pro Tip: Keep an eye on breaking headlines from CoinDesk or CryptoSlate. Pair news with volume charts. That’s your edge.

🧠 Putting It Together: Real-Life Example

Let’s rewind to early 2022.

Russia invaded Ukraine. Headlines exploded. People panicked. Guess what happened to Bitcoin?

- Volume spiked.

- Price dropped.

- Then? A slow rebound as traders realized Bitcoin wasn’t collapsing — it was becoming a hedge against government-controlled money.

Had you looked at volume and connected the dots geopolitically, you might’ve seen the dip not as doom, but as discount.

🧭 The Ultimate Formula for Smarter Bitcoin Moves

You don’t need a PhD in finance. Just use this simple 3-step cheat sheet:

1. Check Volume First

Look at the 24h volume. Spikes? Confirm with price direction.

2. Scan the News

Use Google News and Crypto Panic for alerts. Big macro stories = big market emotions.

3. Don’t React — Strategize

No more “buy high because Twitter said so.” When volume and news align, make your move. Until then, sip tea.

😂 Final Thought: You’re Not Crazy, Just Curious

I used to think I was bad at trading.

Turns out, I was just ignoring volume and chasing vibes. But you? You’re already ahead, because you care enough to learn.

So next time you’re about to ape into a green candle while half-watching cat videos — pause. Check volume. Read the room. The geopolitical room.

And if nothing else, at least you’ll sound smarter at dinner parties. “Actually, I think that recent volume divergence suggests…”

Boom. Instant street cred.

Curious how the pros use volume and news cycles to time Bitcoin moves?

👇 Drop a comment below or subscribe for more crypto guides with zero hype and 100% honesty.

Pingback: BlackRock’s ETFs and Tokenized Funds - the Future of Crypto? - Blockchain Monie

399gd8