The Dark Side of Crypto: When Trading Turns Tragic

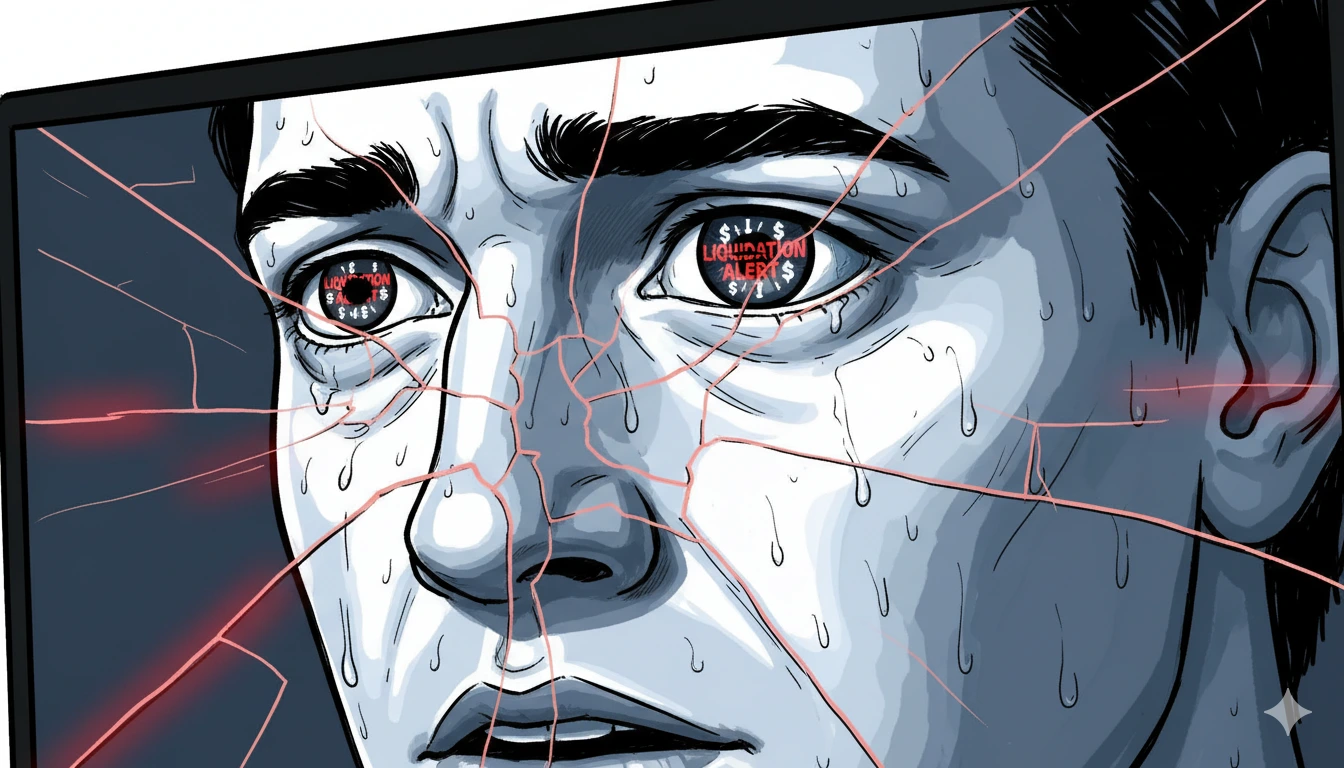

At first glance, crypto trading seems like the ultimate path to freedom—an innovative system that empowers individuals to control their financial future. However, behind the glowing screens and skyrocketing charts lies a much darker truth. Beneath the surface of every gain and every loss, there exists a human story filled with obsession, exhaustion, and emotional collapse.

Indeed, while most people focus on the money, few talk about the mental toll. Every price surge fuels excitement and hope; every crash tears down confidence and stability. Consequently, the true danger in crypto trading might not be financial—it might be psychological.

When the Market Becomes a Mirror

To begin with, crypto trading reflects human emotion more than logic. It magnifies greed, fear, and impatience. Yet, as the market evolved, technology began to outpace human control.

Originally, algorithms were created to make trading more efficient. Over time, however, they learned to exploit human weaknesses. Now, bots trade faster than thought, transforming volatility into chaos and turning opportunity into panic.

As a result, traders often feel like they’re no longer competing against others, but against machines that never sleep.

“It’s no longer humans trading crypto—it’s humans trying to survive algorithms.”

Each major crash, therefore, serves as a brutal reminder that automation can amplify emotion rather than eliminate it. Whales manipulate market trends while retail traders—fueled by hope and leverage—become mere fuel for the system.

The Hidden Cost of Endless Screens

Furthermore, crypto markets never close. Unlike traditional finance, there is no closing bell, no Sunday break, and no pause for reflection. Consequently, traders find themselves caught in a cycle of sleepless nights and constant notifications.

According to the European Journal of Behavioral Addictions, nearly 37% of crypto traders show signs of compulsive trading behavior. The act of checking Bitcoin’s price activates the same dopamine response as gambling.

Therefore:

- One victory feels intoxicating.

- One loss feels catastrophic.

- Both experiences keep traders trapped in the loop.

Over time, ambition quietly transforms into addiction. The trading screen becomes both mentor and manipulator—offering hope while draining energy, time, and mental clarity.

When Profits Turn to Panic

In October 2025, the crypto world once again witnessed the dark side of its own creation. Within just 24 hours, nearly $19 billion vanished from the markets. Bitcoin briefly plunged below $109,000 before rebounding—but by that time, countless traders had already been wiped out.

Among them was Konstantin Ganich, a trader whose story quickly became a symbol of tragedy. After losing his fortune overnight, he was found lifeless. Sadly, his story was not an isolated case. Similar incidents followed the collapses of Terra Luna and FTX, revealing a repeating pattern of pain.

Typically, it unfolds as follows:

- Retail traders chase green candles.

- Whales quietly exit positions.

- Algorithms detect weakness and trigger panic.

- Billions vanish in hours.

Thus, what appears as volatility is, in fact, a system engineered to exploit emotion—rewarding obsession while punishing caution.

The Addiction Behind the Ambition

Additionally, crypto’s language disguises its addictive potential. Phrases like “financial freedom” and “early adoption” create a sense of empowerment. Yet beneath the marketing lies an emotional trap—dopamine disguised as discipline.

As profits rise, traders equate success with self-worth. When losses occur, guilt and anxiety take over. Gradually, identity merges with market performance.

“You stop trading charts and start trading emotions.”

Moreover, social media worsens the problem. Profit screenshots flood Twitter and Telegram, portraying endless success. However, when the market turns, those same voices go silent, leaving others to suffer in private.

The Algorithmic Age of Anxiety

On top of that, today’s markets are no longer driven purely by human fear. Instead, panic itself has been coded into the system. Algorithms analyze sentiment, monitor liquidation levels, and react faster than any human could.

In other words, fear has become mechanized.

Therefore, traders are often liquidated not because of mistakes—but because of machine precision. The result? More people losing not just money, but also peace, health, and, tragically, even their lives—all in pursuit of “financial freedom.”

Breaking the Cycle

Ultimately, the dark side of crypto trading is not greed—it’s the belief that more money will bring more meaning. True wealth, however, begins where obsession ends.

To stay grounded, traders must:

- Set emotional and financial limits.

- Step away from screens regularly.

- Separate personal identity from market performance.

- Learn before leveraging.

After all, no profit is worth your peace.

Final Reflection

In conclusion, crypto was designed to free humanity from centralized systems. Yet without balance, it risks enslaving us to our own impulses. Every chart, every candle, and every algorithm tells a deeper story—not about finance, but about faith.

Faith in technology. Faith in timing. Faith that can, all too often, turn fatal.

“The market will rise again. But will you?”

If this story resonates with you, share it—not to chase hype, but to raise awareness. Join the Blockchain Monie Community on Telegram and learn how to survive the future of crypto trading… with your mind, your money, and your humanity intact.