Trump Media & Technology Group (TMTG) has announced plans to raise $2.5 billion to invest in Bitcoin. This decision positions TMTG as a significant player in the cryptocurrency arena, aiming to leverage Bitcoin as a means to achieve financial freedom. But is this a strategic step towards financial freedom, or a high-stakes gamble that could backfire?

Understanding the Move: Trump Media’s Bitcoin Strategy

The Announcement

TMTG, the parent company of Truth Social, revealed its intention to raise $2.5 billion – comprising $1.5 billion in equity and $1 billion in debt – to build a substantial Bitcoin treasury. CEO Devin Nunes emphasized that this initiative aligns with the company’s “America First” values. These are core values focusing on asset acquisition and financial freedom.

The Role of Truth.Fi

As part of this strategy, TMTG launched Truth.Fi, a financial services platform that will manage investments in Bitcoin, exchange-traded funds (ETFs), and other cryptocurrencies. The company has partnered with Charles Schwab to provide custodial services and financial advisory, while Yorkville Advisors will manage investment strategies for Truth.Fi.

The Appeal of Bitcoin: A Path to Financial Freedom?

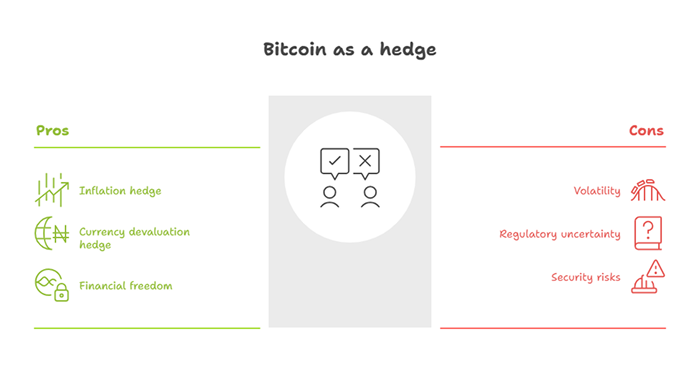

The Case for Bitcoin

Proponents argue that Bitcoin offers a hedge against inflation and currency devaluation, providing a store of value that is not subject to the whims of traditional financial systems. By accumulating Bitcoin, TMTG aims to position itself as a forward-thinking company that embraces digital assets as a means to achieve financial freedom.

Aligning with Political Values

The move also reflects a broader political ideology. By integrating Bitcoin into its financial strategy, TMTG aligns with the “America First” agenda, emphasizing economic independence and resistance to global financial systems that may not align with U.S. interests.

The Risks Involved: Is It a Gamble?

Market Volatility

Bitcoin’s price volatility is well-documented. The cryptocurrency has experienced significant price swings, which could pose risks to TMTG’s financial stability. A sudden downturn in Bitcoin’s value could lead to substantial losses, challenging the company’s financial objectives.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain. Changes in government policies or regulations could impact Bitcoin’s legality and market value, introducing additional risks for TMTG’s investment.

Conflicts of Interest

Critics have raised concerns about potential conflicts of interest, given TMTG’s close ties to political figures. The intertwining of business ventures and political influence could lead to ethical dilemmas and public scrutiny.

Comparing with Industry Peers

| Company | Bitcoin Holdings | Strategy Focus | Market Response |

| MicroStrategy | Over 100,000 BTC | Corporate treasury reserve | Positive |

| Tesla | 42,902 BTC | Investment and innovation | Mixed |

| TMTG (Proposed) | $2.5 billion | Financial independence | Uncertain |

MicroStrategy’s success in leveraging Bitcoin as a corporate asset contrasts with Tesla’s mixed results, highlighting the potential benefits and pitfalls of such strategies.

Expert Opinions: Insights from the Financial Community

Supportive Views

Some financial analysts view TMTG’s move as a bold step towards modernizing corporate finance. They argue that embracing Bitcoin could position the company as a leader in digital asset integration, appealing to a new generation of investors.

Cautionary Perspectives

Conversely, other experts caution against the inherent risks. They point to Bitcoin’s volatility and the uncertain regulatory environment as significant challenges that could undermine TMTG’s financial objectives.

Conclusion: A Calculated Risk or a Step Too Far?

Trump Media’s $2.5 billion investment in Bitcoin represents a significant bet on the future of digital assets. While the potential for financial freedom is enticing, the associated risks cannot be overlooked. The success of this venture will depend on market conditions, regulatory developments, and the company’s ability to navigate the complexities of integrating cryptocurrency into its financial freedom strategy.

What are your thoughts on TMTG’s Bitcoin investment? Do you see it as a strategic move towards financial freedom, or a risky gamble? Share your opinions in the comments below and join the conversation.

RECAP

Trump Media & Technology Group (TMTG) aims to achieve financial independence by leveraging Bitcoin as a core asset. The investment reflects the company’s belief that Bitcoin offers a hedge against inflation and traditional financial instability, aligning with its broader “America First” vision of economic autonomy and technological innovation.

Truth.Fi is a newly launched financial services platform by TMTG designed to manage its digital asset investments, including Bitcoin, ETFs, and other cryptocurrencies. The platform collaborates with Charles Schwab for custodial services and Yorkville Advisors for strategic investment oversight, aiming to build a decentralized financial ecosystem.

Key risks include:

Volatility: Bitcoin’s value is highly unpredictable, which could result in substantial financial losses.

Regulatory uncertainty: Future government regulations could impact Bitcoin’s legality or value.

Ethical concerns: Given TMTG’s political affiliations, the investment may raise questions about transparency and conflicts of interest.

While Tesla and MicroStrategy have also invested in Bitcoin, their strategies differ. MicroStrategy uses Bitcoin as a long-term treasury reserve and has seen strong support, while Tesla faced mixed reactions. TMTG’s proposed $2.5 billion stake places it among the top corporate holders but with less proven track record, making the outcome more uncertain.

It’s a mix of both. The move aligns with the concept of financial freedom by promoting independence from centralized financial systems. However, the political messaging—such as aligning with “America First” economic policies—suggests that the strategy also serves symbolic and ideological purposes alongside financial ambitions.

Pingback: GameStop's $513 Million Bitcoin: Financial and Strategic Management or Ricky Gamble? - Blockchain Monie