You’re standing at the edge of a seismic shift in the media world, heart racing with the thrill of possibility. How to invest in Warner Bros Discovery’s (WBD) upcoming split in 2025 isn’t just a question. It’s your ticket to potentially life-changing returns. The media giant, home to iconic brands like HBO, CNN, and Discovery, announced a bold move to split into two publicly traded companies by mid-2026. This isn’t just corporate restructuring; it’s a chance for you, the savvy investor, to ride the wave of a transforming industry. Picture yourself capitalizing on this moment, but where do you start? Let’s dive into the emotional and strategic journey of investing in WBD’s split, with insights to help you win big.

Why the Warner Bros Discovery Split Matters to You

The media landscape is a battlefield. Streaming giants like Netflix dominate, while traditional cable TV fades. WBD’s decision to split its streaming and studios business (think HBO Max and Warner Bros. films) from its global networks (CNN, TNT Sports, Discovery) is a response to this upheaval. This move, announced on June 9, 2025, aims to unlock shareholder value by giving each entity sharper focus. As an investor, this split is your chance to bet on either the growth-driven streaming side or the cash-flowing networks—or both.

Imagine the excitement of investing in a company poised for agility. The streaming and studios unit, led by CEO David Zaslav, will chase growth with HBO’s prestige and blockbuster films like A Minecraft Movie, which grossed $900 million globally. Meanwhile, the global networks, under CFO Gunnar Wiedenfels, will focus on profitability, leveraging cash cows like CNN and Discovery. But here’s the catch: the networks will carry most of WBD’s $37 billion debt. Your heart might skip a beat at that number, but don’t worry—this guide will help you navigate the risks and rewards.

Step 1: Understand the Split and Its Investment Potential

Before you jump in, let’s break down what this split means for your portfolio. WBD’s restructuring, expected to complete by mid-2026, will create two distinct companies:

- Streaming & Studios: Includes HBO Max, Warner Bros. Motion Picture Group, DC Studios, and more. This entity will focus on growth, targeting streaming subscribers (122.3 million as of Q1 2025) and blockbuster content. It’s the high-risk, high-reward play, with less debt but fierce competition from Netflix and Disney+.

- Global Networks: Encompasses CNN, TNT Sports, Discovery, and other linear TV assets. This unit will prioritize cash flow and debt reduction, carrying most of WBD’s $37 billion debt. It’s a safer bet for income-focused investors but faces cord-cutting challenges.

Why does this matter? The split allows you to choose your investment style. Are you a dreamer chasing streaming’s explosive potential, or a pragmatist drawn to steady cash flows? The choice is yours, but understanding both entities is key to knowing how to invest.

Step 2: Research Warner Bros Discovery’s Financial Health

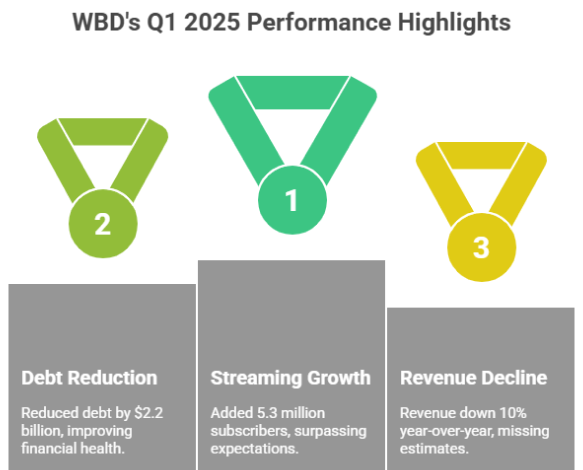

Investing without research is like diving into a pool without checking the depth. WBD’s financials offer clues to its potential post-split. In Q1 2025, WBD reported:

- Revenue: $8.98 billion, down 10% year-over-year, missing analyst estimates due to a weak box office and declining TV networks revenue.

- Streaming Growth: Added 5.3 million subscribers, surpassing expectations, showing strength in HBO Max and Discovery+.

- Debt: Reduced by $2.2 billion in Q1, but still at $38 billion gross. Most will stay with the networks business, potentially impacting its stock valuation.

- Free Cash Flow: $0.3 billion, reflecting the networks’ ability to generate cash despite declines.

These numbers tell a story of resilience amid challenges. The streaming unit’s subscriber growth is a beacon of hope, while the networks’ cash flow offers stability. But the debt load? That’s the shadow looming over your decision. Check WBD’s investor relations page for the latest earnings reports to stay informed.

Step 3: Choose Your Investment Strategy

Now, let’s get personal. How do you, with your unique goals and risk tolerance, approach this opportunity? Here are three strategies to consider when learning how to invest in WBD’s split:

Strategy 1: Bet on Streaming & Studios

If your heart races at the thought of growth, the streaming and studios unit is your play. This entity will be leaner, with less debt and a focus on expanding HBO Max globally. Recent hits like Sinners and A Minecraft Movie show its potential to compete with streaming giants. However, competition is fierce, and profitability remains a hurdle.

- Pros: High growth potential, less debt, iconic brands like HBO and DC.

- Cons: Intense competition, inconsistent box office performance.

- Best for: Growth investors with a higher risk tolerance.

Strategy 2: Play it Safe with Global Networks

If stability is your comfort zone, the global networks unit might be your pick. It generates significant cash flow from brands like CNN and Discovery, despite cord-cutting trends. The catch? It inherits most of WBD’s debt, which could weigh on its stock price.

- Pros: Strong cash flow, established brands, potential for mergers or acquisitions.

- Cons: Heavy debt load, declining linear TV market.

- Best for: Income-focused investors seeking stability.

Strategy 3: Diversify Across Both

Why choose one when you can have both? After the split, you can invest in both companies to balance growth and stability. This approach spreads your risk and lets you benefit from the unique strengths of each entity.

- Pros: Balanced exposure to growth and income, diversified risk.

- Cons: Requires more capital, complex to monitor two stocks.

- Best for: Investors with a moderate risk tolerance and larger portfolios.

Step 4: How to Buy Warner Bros Discovery Stock

Ready to take the plunge? Here’s how to invest in WBD stock before the split:

- Open a Brokerage Account: Choose a platform like Fidelity or Robinhood that suits your needs. Look for low fees and user-friendly interfaces.

- Fund Your Account: Transfer money from your bank to your brokerage account. Start small if you’re new to investing.

- Place Your Order: Search for WBD (NASDAQ: WBD) on your platform. Decide between a market order (buy at current price) or a limit order (set your price). As of June 9, 2025, WBD trades at around $10.03, with fractional shares available on platforms like eToro.

- Monitor Your Investment: Track WBD’s performance using tools like Yahoo Finance or CNBC. Set alerts for price changes or news.

Pro Tip: Use dollar-cost averaging to invest a fixed amount regularly, reducing the impact of market volatility.

Step 5: Weigh the Risks and Rewards

Investing in WBD’s split is like riding a rollercoaster—thrilling but nerve-wracking. Here’s a quick breakdown:

| Factor | Streaming & Studios | Global Networks |

| Growth Potential | High (streaming subscriber growth) | Moderate (cash flow focus) |

| Risk Level | High (competition, box office volatility) | Moderate (debt burden, declining TV) |

| Debt Impact | Lower (less debt allocated) | Higher (most of $37B debt) |

| Investor Appeal | Growth-oriented, risk-tolerant | Income-focused, risk-averse |

The streaming unit’s potential is exciting but volatile, like betting=on a summer blockbuster. The networks unit offers stability but carries a heavy debt load, like a trusty old car with a big loan. Posts on X highlight investor enthusiasm, with WBD’s stock jumping 8% after the split announcement, but some warn about the networks’ debt burden.

Step 6: Stay Ahead of the Curve

The media industry is evolving fast. Keep an eye on trends like cord-cutting, streaming wars, and potential mergers. WBD’s networks could attract private equity buyers, while the streaming unit might pursue global expansion.

Your Path to Winning Big

You’re at a crossroads, with the Warner Bros Discovery split offering a rare chance to shape your financial future. Whether you’re drawn to the streaming unit’s bold vision or the networks’ steady cash flow, how to invest starts with research, strategy, and courage. Picture yourself a year from now, portfolio thriving, proud of the smart moves you made today. Take the first step—open that brokerage account, dive into WBD’s financials, and choose your path.

2sw7ob